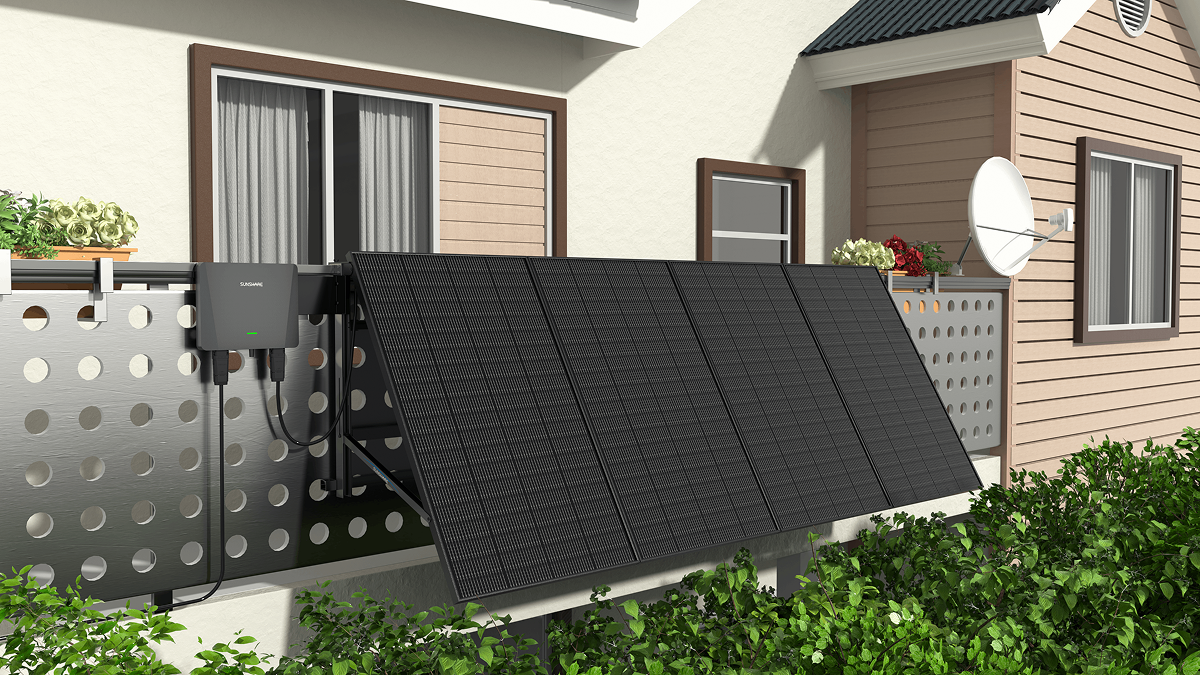

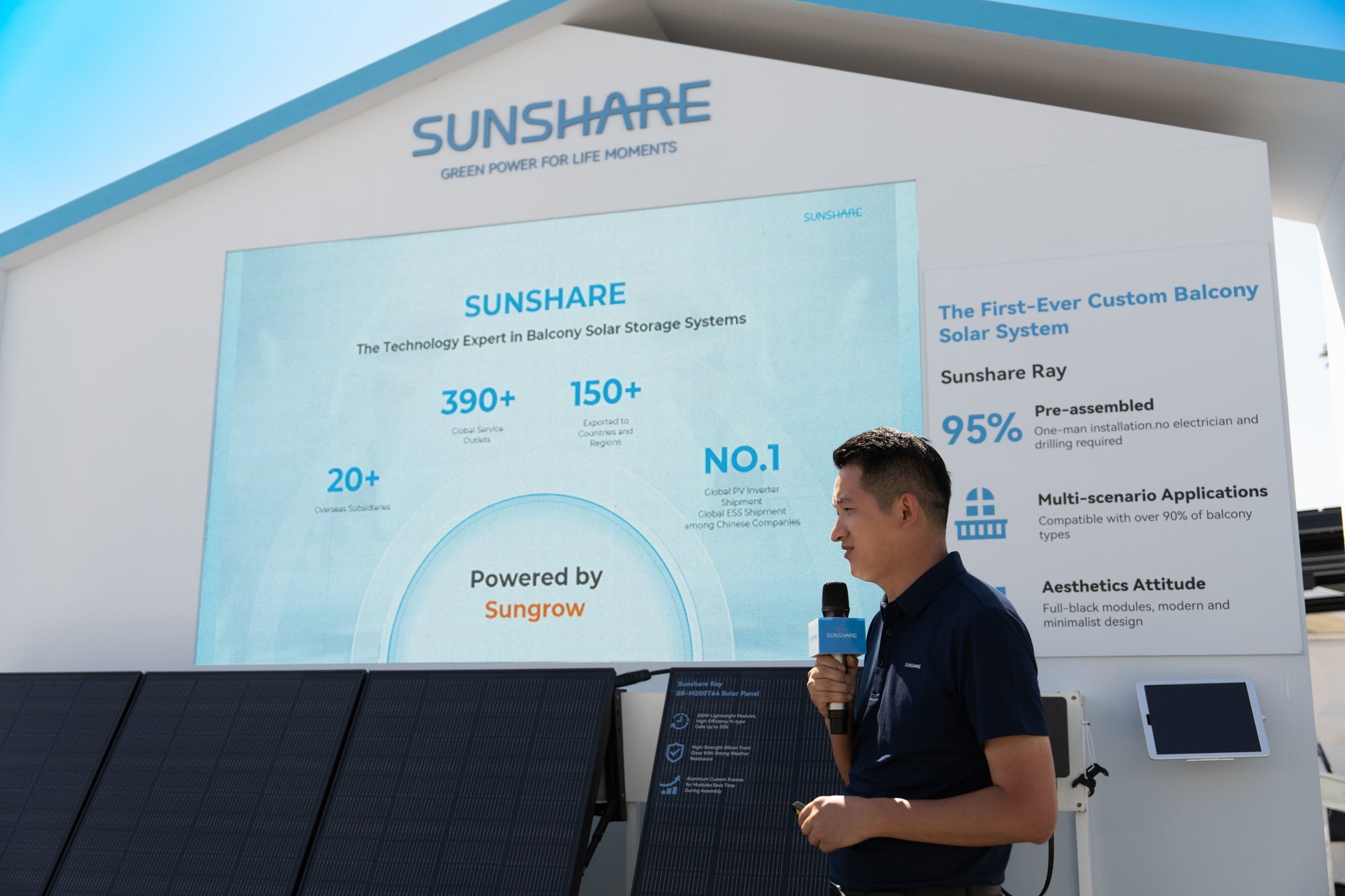

Good news! Germany's The zero tax policy for photovoltaic equipment below 30kWp will continue

For multi-family residential photovoltaic systems with single-family residential installations less than 30kWp or less than 100kWp, the German government will continue to implement tax relief policies, namely:

(1) The 19% value-added tax arising from the purchase, import and installation of photovoltaic equipment is exempted

(2) The feed income of the photovoltaic system is exempt from personal income tax;

(3) Simplify the tax process and do not need to apply for additional tax rebates.

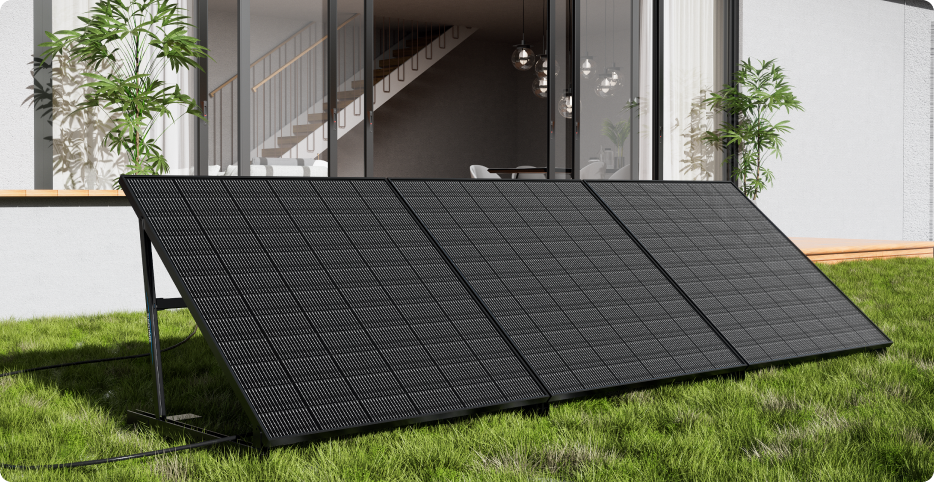

For end users, as the price of installing photovoltaic energy storage becomes more attractive, this initiative will continue to stimulate the continued growth of the German household photovoltaic market and promote the popularity of photovoltaic systems, and it is foreseeable that the household market share will continue to grow steadily in the future.